Challenge Passing Services

#1 Account Management

We are primarily interested in managing funded accounts with a minimum balance of $100,000

#2 Passing Challenges

This service is available to help you obtain a large funded account if you don’t want to risk your own capital or don’t have a lot to invest.

Already Have A Live Funded Account?

SEE FAQ SECTION FOR FULL LIST OF PROP FIRMS WE ACCEPT

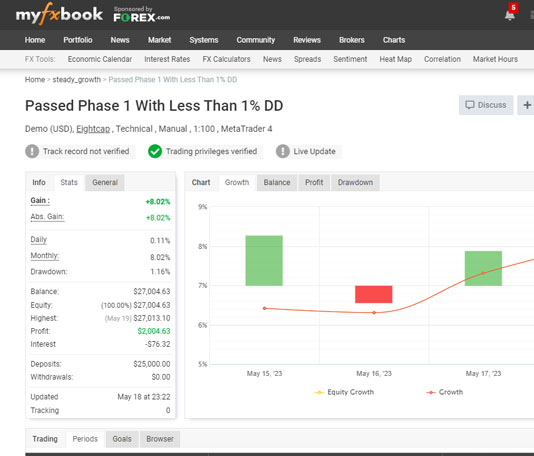

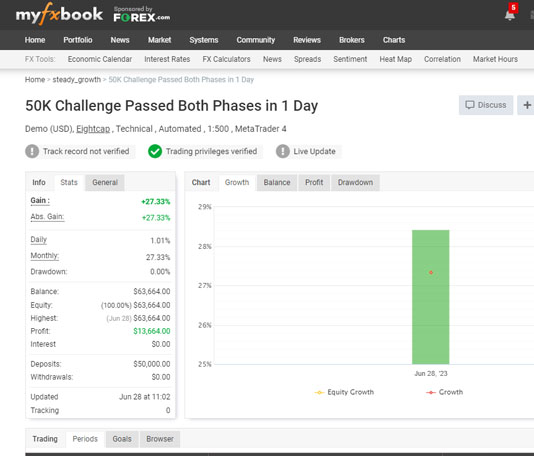

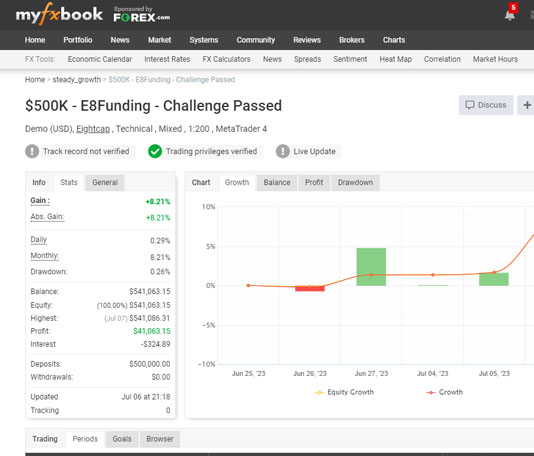

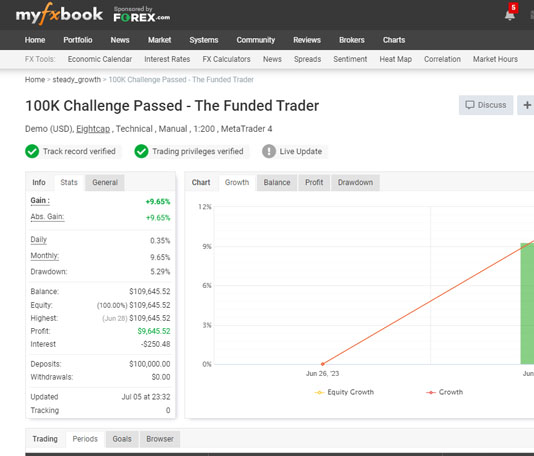

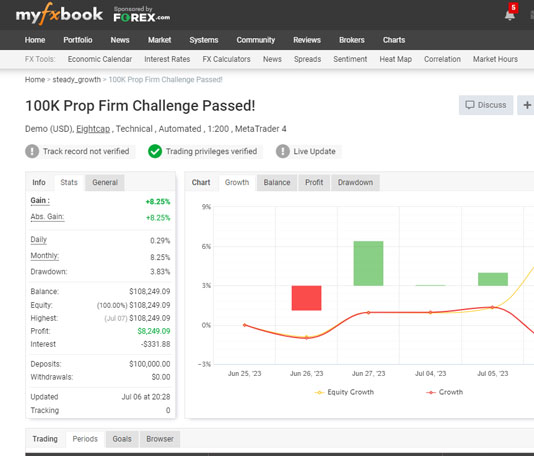

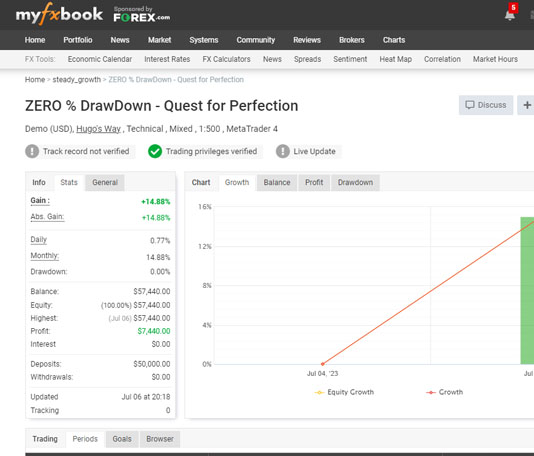

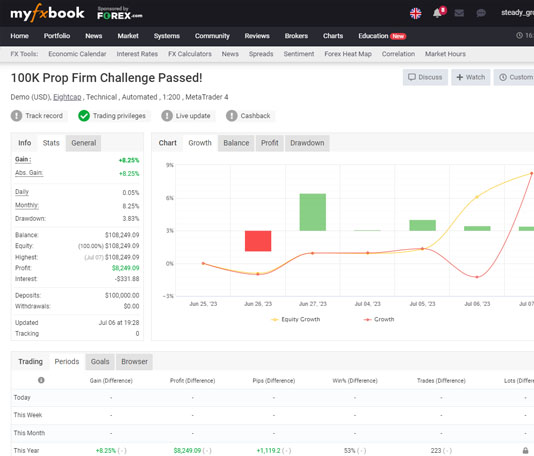

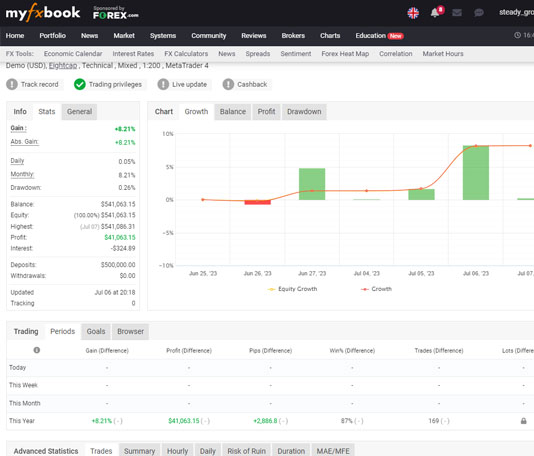

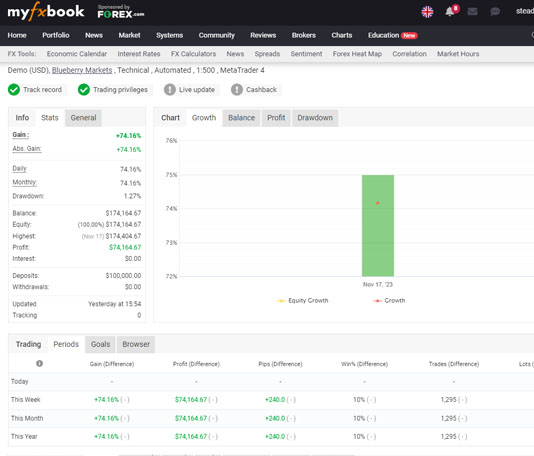

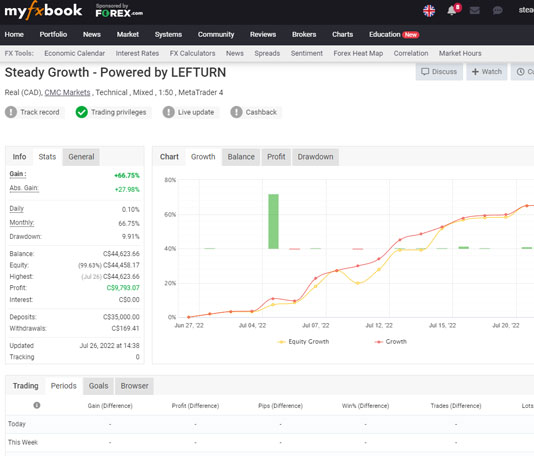

PREVIOUSLY PASSED CHALLENGES

Due to integrity of our client accounts, we no longer post the most recent passed challenges.

Prop Firm Frequently Asked Questions

List Prop Firms We Accept Firms

8 Figure Trader

Alpha Capital Group

AquaFunded

Ascendx Capital

Audacity Capital

Blue Guardian

Breakout P

BrightFunded

City Traders Imperium

Crypto Fund Trader

E8 Markets

FTMO

FXIFY

For Traders

Funded Engineer

Funded Trading Plus

FundedNext

Funding Pips

Funding Traders

Glow Node

Goat Funded Trader

Instant Funding

Lark Funding

Maven

Ment Funding

My Flash Funding

My Funded FX

Smart Prop Trader

Swift Funding

The 5%ers

The Trading Pit

Traddoo

True Forex Funds

UWM

If we fail your challenge using one of our recommended HFT prop firms, we offer you a full refund of our service fee.

We are a group of professional traders that trades for our investors and clients on their behalf. Whether you have a broker or prop firm account, to get started with us, you just simply send us your MT4 login credentials. Once we receive your credentials we can trade your account on your behalf.

If you're interested in hiring us to pass your prop firm challenge, you'll need to purchase a challenge from any forex prop firm that allows a daily drawdown limit of at least 5%. After purchasing the challenge from the prop firm, you'll need to provide us with your credentials by completing our challenge application form.

For HFT prop firms, we can pass the challenge and get you funded typically within the same dat.

For traditional prop firms that offer single phase challenges, we can pass it on average within 1-2 weeks. For two phase challenges, it may take up to 30 days.

Yes, absolutely! Click here to get started by filling out our Live Account Management form.

Yes, as long as the challenge allows a daily drawdown of 5%. Furthermore, we prefer to work with prop firms that allow HFT (high frequency trading) in the evaluation phase.

96.2% of the challenges we take on get fully funded.

FTMO allocates a maximum of $400k per trader. On their website they only offer $200k accounts but you can purchase 2 of the $200k accounts at the same time.

With HFT prop firms, they cap performance at 6%. This means we if we reach a 10% gain, they will cap it at 6% so we will lose the remaining 4%. However, with other traditional prop firms such as FTMO, we can generate much greater returns - sometimes around 15%

No. Since your account will never have the exact same trades as another account with the same broker, it's impossible for your account to be taken away for "Copy Trading".

Yes, absolutely.. You can have 2 accounts with FTMO, 2 accounts with a HFT prop firm and so on. We do not limit you in how many accounts you can have with us. At the time of writing this, we have the capacity to manage all of the accounts you send us.

Account Size |

Your Share |

Our Share |

|---|---|---|

| < $100,000 | 40% | 60% |

| $100,000 | 55% | 45% |

| $200,000 | 60% | 40% |

| $300,000 | 63% | 37% |

| $300,000 + | 65% | 35% |

Since all accounts are opened and owned by our investors with their preferred broker, we will never have direct access to your funds. For us to get paid, we send out invoices on a 30 day billing-cycle which includes many payment methods.

Yes, once you register for a challenge account with us, you'll receive a digital copy of our management agreement in your inbox. You can also view this agreement by clicking here.

GET STARTED TODAY

Below is a list of our fees for passing prop firm challenges based on the account size. We guarantee we’ll pass your challenge and get you funded or else we provide a no questions asked instant full refund.

Or...

Let us Manage Your Live Funded Account

CHALLENGE PASSING SERVICES

Proprietary trading firms, commonly known as “prop firms,” often offer challenges or evaluation processes for traders to showcase their skills and potentially get funded. These challenges serve as a way for the firm to assess the trader’s abilities and risk management skills before providing them with capital to trade. Here’s an outline of how such challenges typically work:

1. Application and Evaluation

- Traders apply for the challenge by submitting their trading strategies, performance records, and sometimes, a nominal fee.

- The prop firm evaluates the trader’s application based on various criteria such as trading experience, risk management skills, profitability, and strategy robustness.

2. Challenge Structure

- Once accepted, the trader is given a simulated trading account with virtual capital to trade.

- The challenge typically has predefined rules and objectives, such as achieving a certain profit target or maintaining specific risk parameters.

- The duration of the challenge varies depending on the firm, ranging from weeks to months.

3. Trading Performance Evaluation

- Throughout the challenge, the prop firm monitors the trader’s performance, including factors such as profitability, drawdowns, risk management, and adherence to the trading rules.

- Some firms may provide traders with regular feedback and guidance to help them improve their performance.

4. Passing Criteria

- To successfully pass the challenge, traders usually need to meet specific performance metrics set by the prop firm. These metrics often include achieving a certain level of profitability, managing risk effectively, and demonstrating consistency in trading.

- Passing criteria may vary between firms and depend on factors such as trading style, market conditions, and risk tolerance.

5. Funding and Partnership

- Traders who successfully meet the challenge criteria may be offered a funded trading account by the prop firm.

- The funded account allows traders to trade with the firm’s capital, and they typically earn a share of the profits generated, while the firm takes a percentage as well.

- Some prop firms may also offer additional support, training, and resources to traders who join their program.

6. Continuous Evaluation and Growth

- Even after passing the initial challenge and receiving funding, traders are usually subject to ongoing evaluation and performance reviews.

- Prop firms may provide further training, mentoring, and risk management support to help traders improve their skills and grow their trading accounts.

- Traders are expected to maintain consistent performance and adhere to the firm’s trading rules and guidelines.

By successfully navigating these challenges and demonstrating their trading abilities, traders can secure funding and potentially forge long-term partnerships with prop firms, enabling them to pursue their trading careers with access to additional capital and resources.

CHALLENGE PASSING ADVICE

Passing proprietary trading firm challenges requires a combination of skill, discipline, and strategy. Here are some tips and strategies to increase your chances of success:

1. Understand the Rules:

- Thoroughly read and understand the rules and objectives of the challenge provided by the prop firm.

- Pay attention to details such as trading instruments allowed, risk parameters, profit targets, and duration of the challenge.

2. Develop a Robust Trading Plan:

- Create a well-defined trading plan that outlines your strategy, including entry and exit criteria, risk management rules, and position sizing.

- Choose a trading strategy that suits your style and preferences, whether it’s trend following, mean reversion, scalping, or others.

- Backtest your strategy extensively to ensure its effectiveness under different market conditions.

3. Focus on Risk Management:

- Prioritize risk management to protect your capital and minimize drawdowns.

- Set stop-loss levels for each trade based on your risk tolerance and market volatility.

- Limit the size of each position to a small percentage of your trading capital to prevent overexposure to risk.

4. Stay Disciplined:

- Stick to your trading plan and avoid emotional decision-making.

- Maintain discipline during both winning and losing streaks.

- Avoid revenge trading or deviating from your strategy in response to losses.

5. Manage Your Emotions:

- Keep emotions such as fear, greed, and overconfidence in check.

- Accept losses as a natural part of trading and focus on the long-term outcome.

- Practice mindfulness techniques or meditation to stay calm and focused during trading.

6. Stay Informed and Adaptive:

- Stay updated on market news, economic indicators, and geopolitical events that may impact your trading instruments.

- Be prepared to adapt your strategy based on changing market conditions.

- Continuously monitor your performance and adjust your approach as needed.

7. Keep Detailed Records:

- Keep thorough records of your trades, including entry and exit points, position size, profit and loss, and reasons for trade decisions.

- Analyze your performance regularly to identify strengths and weaknesses in your strategy.

- Use trading journals or software to track your progress and make data-driven improvements.

8. Seek Feedback and Guidance:

- Seek feedback from experienced traders or mentors to gain insights into your trading performance.

- Participate in trading communities or forums where you can exchange ideas and learn from others.

- Consider joining a trading education program or mentorship to accelerate your learning curve.

By following these strategies and maintaining a disciplined approach to trading, you can increase your chances of passing prop firm challenges and achieving success as a professional trader.